GROUP 1 AUTOMOTIVE (GPI)·Q4 2025 Earnings Summary

Group 1 Automotive Q4 2025: EPS Misses as Impairments Weigh, But Record Full-Year Revenue

January 29, 2026 · by Fintool AI Agent

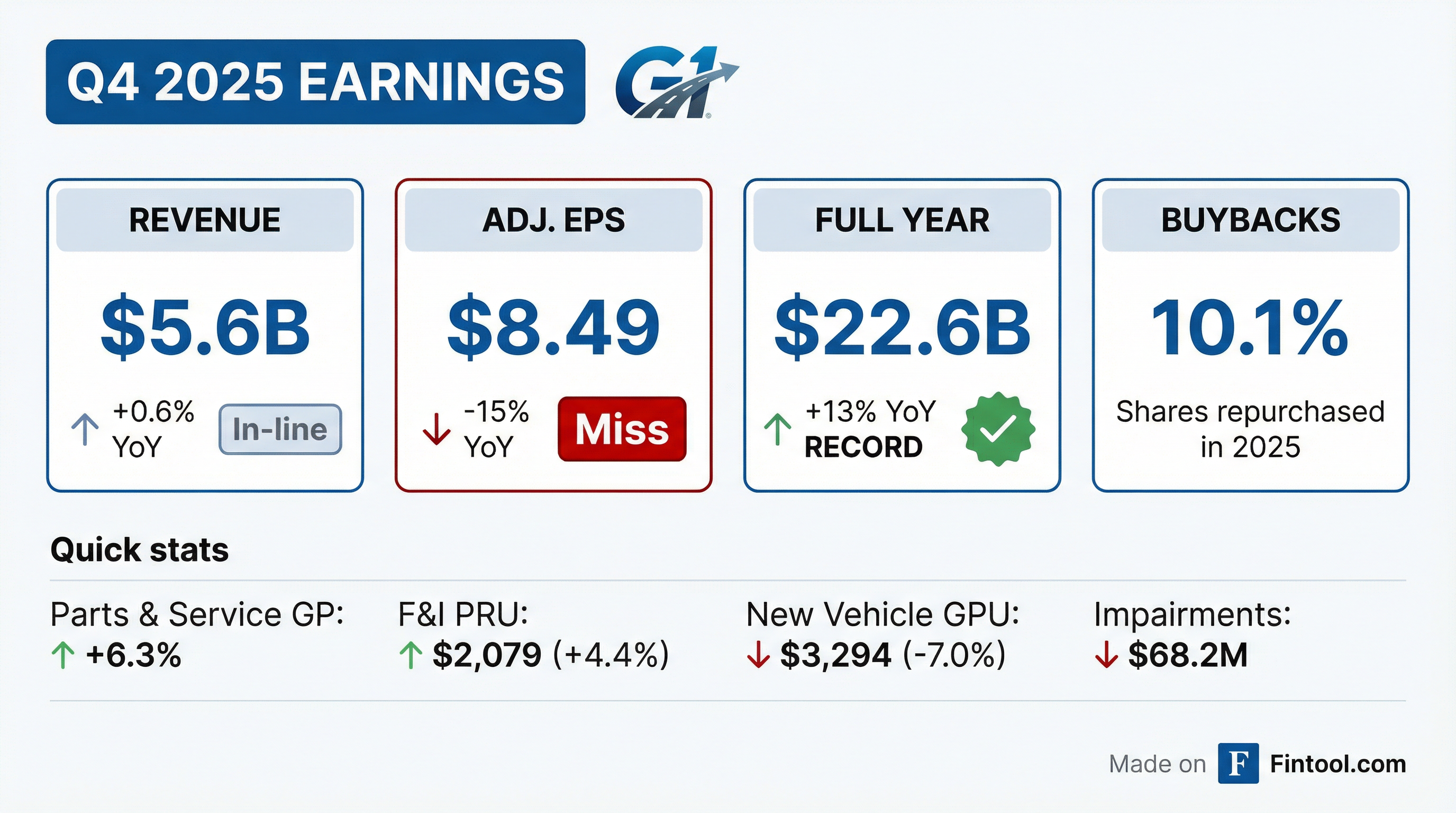

Group 1 Automotive (NYSE: GPI) reported Q4 2025 results that fell short of expectations, with adjusted EPS of $8.49 declining 15% year-over-year due to significant impairment charges. However, the auto retailer capped off a record year with $22.6 billion in annual revenue (+13.2%) and aggressive capital returns, repurchasing 10.1% of outstanding shares.

The stock traded down approximately 2.9% in after-hours to $385, as investors digested the mixed quarter against an otherwise strong full-year performance.

Did Group 1 Automotive Beat Earnings?

No — GPI missed on EPS while revenue was roughly flat. The quarter was materially impacted by $68.2 million in non-cash asset impairments, primarily attributable to the U.S. reporting unit.

The adjusted EPS figure of $8.49 excludes the impact of impairments, restructuring charges, and other non-core items. On a GAAP basis, EPS plunged 51% to $3.47 due to $68.2M in asset impairments and $8.1M in U.K. restructuring charges.

What drove the miss? Declining gross profit per unit across both new and used vehicles, combined with higher SG&A expenses as a percentage of gross profit:

Impairment details: On the Q&A, CFO Daniel McHenry noted the Q4 impairments were "virtually totally" in the U.S. (versus Q3 which was U.K.-related), with the Audi brand and the Maryland/D.C. market cited as the primary drivers.

How Did the Stock React?

GPI shares declined approximately 2.9% in after-hours trading to $385, down from the $396.41 close. The stock has fallen 19% from its 52-week high of $490.09, reflecting broader concerns about auto retail margins and economic uncertainty.

The muted reaction suggests the market may have already priced in some weakness, given:

- The stock was down 6% in the week leading into earnings

- Industry-wide concerns about GPU compression have been well-telegraphed

- The strong full-year results and aggressive buybacks provide some offset

What Drove Record Full-Year Results?

Despite the Q4 stumble, GPI delivered record full-year performance across nearly all metrics:

CEO Daryl Kenningham highlighted the diversified business model's resilience:

"Our revenues totaled $22.6 billion, up 13.2% year over year. We achieved record revenues across all of our major business lines and record gross profits in parts and service and F&I, showing the continued strength and resilience of our diversified business model."

The Parts & Service segment was the star, with gross profit up 15.9% to $1.6 billion — a critical profit driver as vehicle margins compress. Gross margin in P&S expanded to 55.7%, up 80 basis points year-over-year.

What's Happening in the U.K.?

The U.K. operations remain a work in progress. GPI announced a restructuring plan in October 2025, recognizing $28.4 million in restructuring charges for the full year ($8.1M in Q4).

Actions taken in 2025:

- Reduced headcount by 537 positions

- Consolidated 10 customer contact centers into 2

- Fully onshored transactional accounting operations

- Completed U.K. systems integration (DMS)

- Working with interested parties on JLR brand exit

- Closed select Toyota, BMW/MINI, and Volkswagen dealerships

Management expects additional restructuring actions in 2026 but noted Q4's $28M charge was unusually large and shouldn't repeat at that level.

The U.K. delivered strong top-line growth but remains less profitable than U.S. operations, with SG&A consuming 84% of gross profit versus 66% in the U.S.

Capital Allocation: 10% of Shares Repurchased

GPI continued its aggressive capital return strategy, repurchasing approximately 10.1% of outstanding shares in 2025 — a significant statement of confidence from management.

Post-quarter activity: Since January 1, 2026, GPI repurchased an additional 71,750 shares at an average price of $394.20 ($28.3 million), reducing share count by approximately 0.6%.

The company also made strategic acquisitions totaling ~$640 million in expected annual revenue, including Lexus/Acura dealerships in Fort Myers, Mercedes-Benz of South Austin, and Mercedes-Benz of Buckhead. At the same time, GPI divested 13 underperforming stores with ~$775 million in annualized revenue.

What Changed From Last Quarter?

*Estimate based on S&P Global data

The quarter-over-quarter decline reflects:

- Seasonal softness in Q4 auto retail (typical)

- Accelerated GPU compression in both new and used vehicles

- Large impairment charges related to U.S. reporting unit

- U.K. restructuring costs continuing to weigh

Balance Sheet & Liquidity

Debt increased 27% to $3.7 billion, partially funding the aggressive buyback program and acquisitions. The company maintains adequate liquidity with $378.7 million remaining under its buyback authorization.

Days' supply in inventory:

- New vehicles: 46 days (vs 44 days last year)

- Used vehicles: 36 days (vs 39 days last year) — improved

What's the Outlook?

GPI did not provide explicit 2026 guidance, but management signaled clear priorities:

"What we're hoping for is to build on 2025... We feel like there's opportunity at Group One to organically grow, especially in the UK. But we still have opportunities in our business in the US, too — in our used car business and in our cost structure." — CEO Daryl Kenningham

Key 2026 priorities:

- U.K. optimization — Management described this as still in "early innings" with additional restructuring actions expected

- Used vehicle improvement — Expecting tailwinds from lease returns and tax refund season

- Continued buybacks — Already repurchased 0.6% of shares since January 1

- Accretive M&A — "Not going to overpay" or buy non-accretive stores

- Luxury GPU recovery — Expecting firming as Mercedes and BMW inventory normalizes

Analyst Consensus for 2026:

*Values retrieved from S&P Global

The consensus view suggests modest EPS growth as GPU compression is offset by continued P&S strength and share count reduction.

Q&A Highlights: What Management Said

AI & Technology Investments

CEO Daryl Kenningham provided detailed commentary on GPI's technology initiatives across the business:

"We are using AI in every part of our business, both customer interface as well as in our back office... Initiatives like virtual F&I, which we've got in a ton of stores now, we're rolling that out nationwide. We're seeing lower cost per transaction on virtual F&I across our footprint."

Key technology deployments:

- AI-driven lead management and CRM in sales operations

- Virtual F&I rollout delivering lower cost per transaction

- Predictive analytics in marketing and customer outreach

- AI-assisted parts & service scheduling

- Data ownership enabling more efficient customer targeting

Technician Productivity & Retention

A notable bright spot: technician turnover declined 10 percentage points, driving measurable productivity gains:

"When you look at our after sales growth this quarter, it was 6% up, 5% up on a same store basis on customer pay and 9% on warranty. We only added 2.5% to our technician base, so our technicians are more productive now."

Investments in shop conditions (including air conditioning) have paid dividends in both retention and output per tech.

U.K. Restructuring: Still "Early Innings"

Management was candid about the U.K. turnaround timeline:

"There's more work to do... I would say we're in the earlier innings, not the later innings." — CEO Daryl Kenningham

Positive U.K. operational signals:

- RO count up 36% year-over-year due to U.S. best practices

- Technician headcount increased 9.5%, expanding shop capacity

- F&I PRU increased 13% ($123) through better product adoption

- Customer pay revenue up 9% YoY

SG&A targets: U.K. targeting 80% of gross profit long-term (higher in non-plate change quarters). U.S. targeting mid-to-high 60s% on an annualized basis.

Chinese OEMs in the U.K.

Chinese automaker market share in the U.K. leveled off at approximately 12% in Q4, though management doesn't expect them to slow down. GPI believes its heavy luxury exposure provides some insulation, as Chinese brands haven't penetrated that segment yet.

Used Car Outlook for 2026

Management expressed optimism about the used vehicle market this year:

"Two things will happen this year which will help the used car business. One is the uptick in lease returns, which, you know, a good, solid, controlled source of premium used cars is really great." — CEO Daryl Kenningham

Additional tailwinds cited:

- Tax refund season expected to buoy demand in Q1-Q2

- Continued focus on organic sourcing from service drives and trade-ins

- AI-assisted auction sourcing ("know exactly what cars to buy")

EV Mix & Margins

GPI's EV mix declined to just 1.3% in Q4 (down from ~3% prior), though management noted EV margins have improved meaningfully from "a disaster" a year ago. Given the small volume, EV dynamics have limited impact on GPI's overall results.

Luxury GPU Softness

On the Q4 new vehicle GPU decline, management specifically called out luxury brands:

"We saw some softening on the luxuries in the fourth quarter, GPUs... Mercedes' inventory is in much better shape today than it was a year ago, and BMW's inventory is in really good shape with some new products coming out this year. So I believe that we'll see firming of the luxury GPUs."

Capital Allocation Philosophy

CFO Daniel McHenry outlined the framework for 2026:

"We really want to grow the company and continue to grow the company through acquisition. We are not going to, however, buy stores that aren't instantly accretive to us... and we're not going to overpay for acquisitions."

Target leverage: below 3x (currently at 3.1x rent-adjusted).

Key Risks Flagged

Management's forward-looking statements highlighted several risks:

- Tariff uncertainty: Potential U.S. tariffs on automobile imports and resulting supply chain disruptions

- BEV mandates in the U.K.: Regulatory requirements that could impact vehicle demand

- Consumer credit conditions: Rising interest rates affecting vehicle affordability

- Foreign exchange volatility: GBP/USD fluctuations impacting U.K. results

The Bottom Line

Group 1 Automotive's Q4 2025 was a disappointment — there's no sugarcoating an adjusted EPS decline of 15% and significant impairment charges. But stepping back, the full-year story remains solid: record revenue, record Parts & Service profits, and management returning over 10% of shares to investors.

The earnings call provided important color:

- AI deployment is already driving productivity gains in service, sales, and F&I

- Technician retention improving (turnover down 10 points) — a key competitive advantage

- U.K. turnaround still in "early innings" but showing operational progress (RO count +36%)

- Lease returns expected to boost used car business in 2026

- Luxury GPUs should firm as OEM inventories normalize

The key questions heading into 2026:

- Can GPU stabilize, or is further compression ahead?

- Will U.K. restructuring deliver meaningful cost savings?

- How will potential tariff policy impact the business?

- Can the used car tailwinds (lease returns, tax refunds) materialize as expected?

For now, the stock's 2.9% after-hours decline suggests the market is giving GPI partial credit for its strong full-year execution while remaining cautious on near-term margin trends.

Related Links: